There is, always was and still is, an option that can again kick-start the New World Order in banking. The Glass-Steagall Act, the 1933 law passed after the Great Depression that separated commercial banks from investment banks, to prevent another financial disaster by limiting the size and power of American banks. The law prompted the breakup of J.P. Morgan & Company, which spun off its brokerage arm to create Morgan Stanley.

With the Depression-era fading from memory, the increasingly powerful banking industry started to chip away at the provisions. One of its foremost critics and leader in the successful effort to repeal the act in the 1990s, Sanford I. Weill, founder of Citigroup, confesses that the repeal was a mistake and in July 2012 called for its reinstatement.

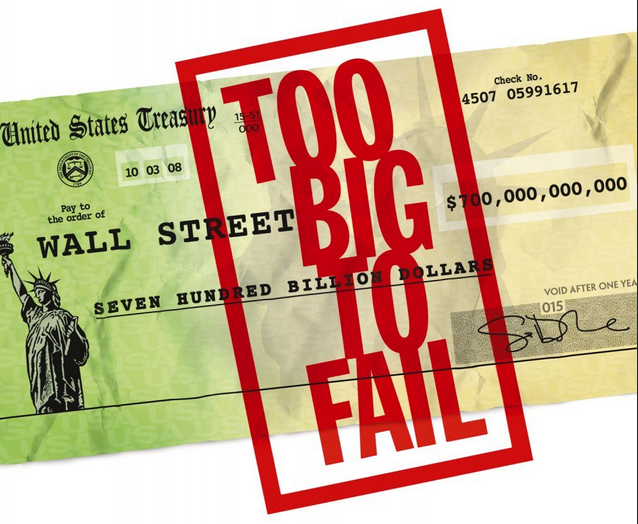

Bottom line: Wall Streets behemoths are too big to regulate and must be cut back down to size. The alternative? Nationalize.

Economists in and around the University of Chicago, who founded the modern conservative tradition, believed that the only way to preserve competition was to nationalize. One of the most important Chicago School leaders, Henry C. Simons, judged in 1934 that “the corporation is simply running away with our economic and political system.”

Simons, a hero of libertarian idol Milton Friedman, was skeptical of enormity. “Few of our gigantic corporations,” he wrote, “can be defended on the ground that their present size is necessary to reasonably full exploitation of production economies.”

Gar Alperovitz, a professor of political economy at the University of Maryland, summed it up best in an Op-Ed column he wrote for The New York Times on July 23, 2012.

“The central problem, then as now, was that very large corporations could easily undermine regulatory and antitrust strategies. The Nobel laureate George J. Stigler demonstrated how regulation was commonly ‘designed and operated primarily for’ the benefit of the industries involved. And numerous conservatives, including Simons, concluded that large corporate players could thwart antitrust ‘break-them-up’ efforts – a view Friedman came to share.

“Simons did not shrink from the obvious conclusion: ‘Every industry should be either effectively competitive or socialized.’ If other remedies were unworkable, ‘The state should face the necessity of actually taking over, owning, managing directly’ all ‘industries in which it is impossible to maintain effectively competitive conditions.’

“Think about it. In the mid-20th century, banks were far less concentrated than they are today, when the five biggest – JPMorgan Chase, Bank of America, Citigroup, Wells Fargo and Goldman Sachs – dominate the industry, with combined assets amounting to more than half of America’s economy.

“With high-paid lobbyists contesting every proposed regulation, it is increasingly clear that big banks can never be effectively controlled as private businesses. If an enterprise or five is so large and concentrated that competition and regulation are impossible, the most market-friendly step is to nationalize its functions.”

Hmmm, money-for-honey thought. Especially today, when banks’ credibility is so low and their clout clobbered.

Photo: Courtesy HBO, Too Big To Fail movie.